–News Direct–

Singapore / March 28, 2024 With the approval of BTC spot ETFs, institutions and individuals worldwide are increasing their holdings of BTC, spurring a surge in the BTC prices. BTC now ranks among the top 10 assets globally by market capitalization. BTC inscriptions and scaling are two niche segments gaining widespread traction in this market cycle. The exploration of diversifying revenue streams from BTC ecosystem assets is drawing the attention of the cryptocurrency market.

So, which solution will become the optimal one to tackle issues such as interest on BTC assets, network confirmation delays, lack of smart contracts, and high gas fees?

Current solutions for enhancing the BTC ecosystem include Layer 2s and sidechains.

As one of the investor of BounceBits 6M funding round, HTX Ventures sees BounceBit, with its CeFi+DeFi product model, as a potentially innovative solution to open up the Bitcoin ecosystem for more application. This research report thoroughly examines BounceBit, outlining its product design philosophy and HTX Ventures' investment rationale.

HTX Ventures, the global investment arm of HTX, leverages an integrated approach that combines investment, incubation, and research to identify the most exceptional and promising teams around the world. To date, HTX Ventures has supported over 200 projects spanning multiple blockchain tracks, with some high-quality projects already listed on HTX for trading.

What Is BounceBit?

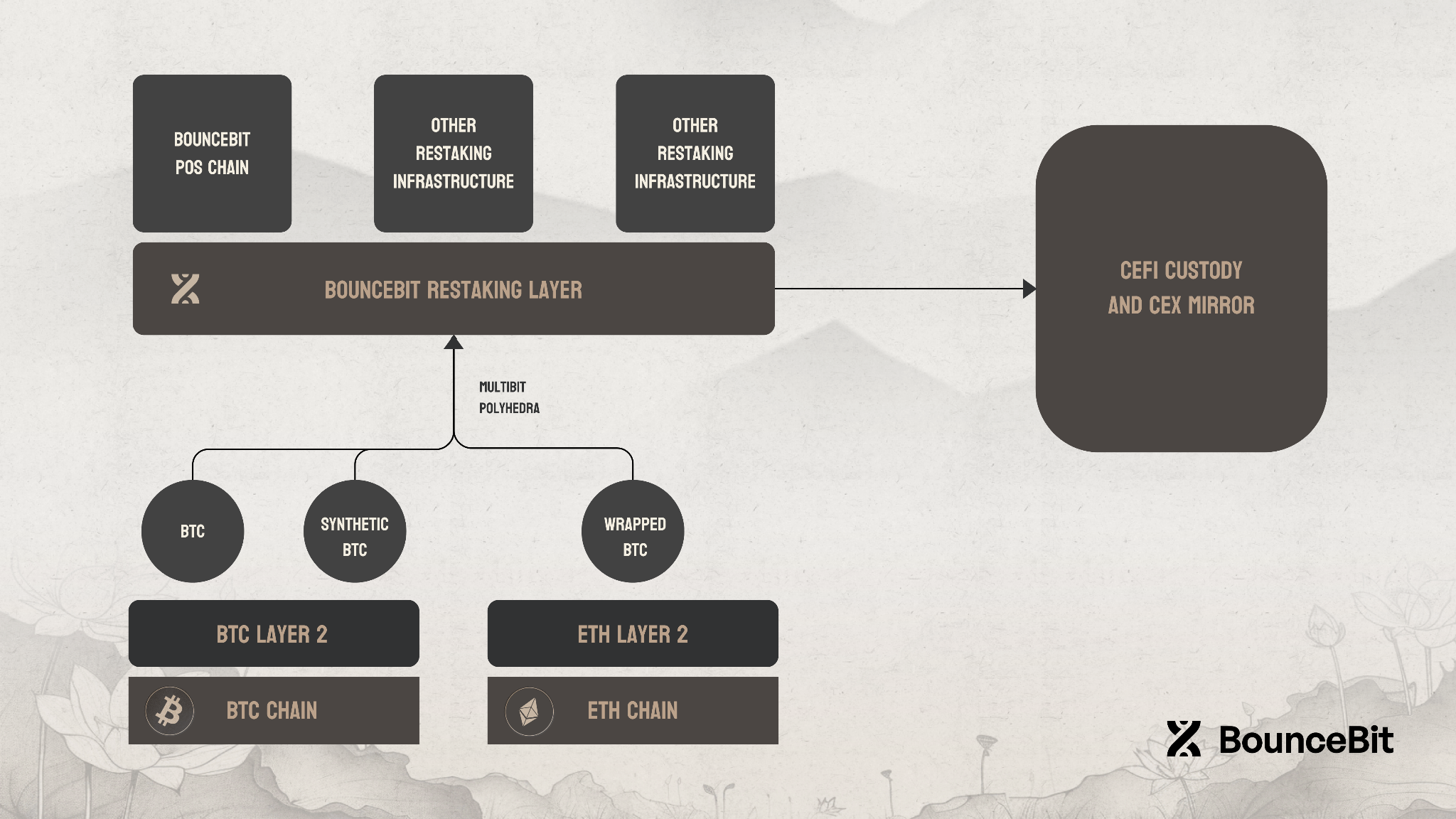

BounceBit is a BTC restaking chain exclusively designed for Bitcoin, building BTC restaking infrastructure that provides a foundational layer for different restaking products, secured by the regulated custody of Mainnet Digital and Ceffu. It employs a BTC + BounceBit hybrid PoS mechanism for validation.

BounceBit resolves trust issues with underlying BTC assets through multi-party custodianship, creating BBTC for DeFi interactions on the Bounce mainnet. Native BTC assets are used to participate in low-risk arbitrage strategies on various centralized exchanges. Additionally, under a hybrid token staking mechanism, using BBTC+BB (BounceBit's native token) for staking can generate LSD tokens, further obtaining node staking rewards and restaking profits.

By combining centralized custody and sidechains, BounceBit aims to address the longstanding trust issues of sidechains while reinvigorating the BTC ecosystem. This will reduce trading fees and unlock the financial potential of BTC, enabling access to applications in DeFi, gaming, social, and more sectors.

How Does BounceBit Work?

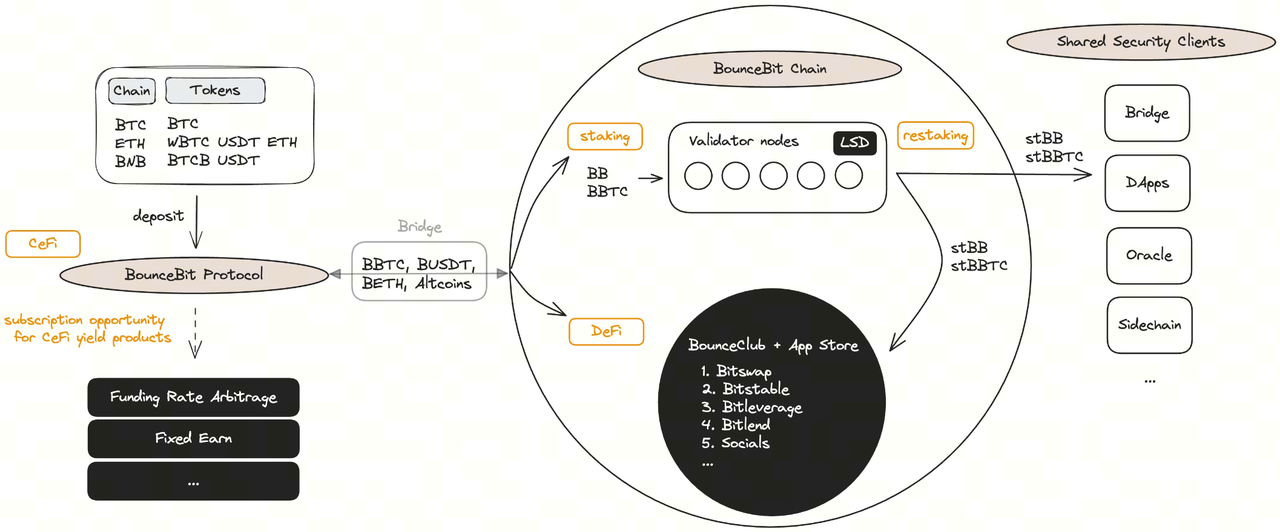

BounceBit's product design is very ingenious, as shown in the following diagram:

Users deposit multiple types of on-chain Bitcoin assets into the BounceBit Protocol which is actually supervised by BounceBit, CEFFU, and Mainnet Digital under a jointly managed MPC wallet. This setup is to address trust mechanism issues and ensure the security of user assets.

- By using off-exchange settlement (OES) solutions like Ceffus MirrorX, it gives protocol secure access to the deep liquidity on exchanges and earn yield through diverse trading strategies, while funds stay safe on-chain in MPC wallets, a wallet technology that essentially splits the private key into multiple shards. This way the single point of failure (SPOF) risk is reduced to a minimum. Additionally counterparty-risk is reduced, as the user funds are never actually stored on any centralized exchange, but rather are mirrored by Ceffu.

- BounceBit works with multiple experienced asset managers with a longstanding positive return track record to trade through MirrorX. All of the asset managers use Funding Rate Arbitrage as their trading strategy. Funding Rate Arbitrage is a profitable delta-neutral strategy which capitalizes on the difference of the funding rate between different markets.

- On the other hand, after users transfer their native assets into BounceBit, a new asset, B-Token, will be minted. Taking BTC as an example, after depositing BTC, users will receive BBTC assets that operate on the BounceBit mainnet. Currently, there are two main types of on-chain activities for this asset: First, under BounceBit's hybrid staking model, using BBTC+BB (the project's native token) to participate in node staking, while the LST generated from staking can further engage in restaking activities, further amplifying staking returns; second, BBTC can be used in various DeFi interactions on-chain. Currently, BounceBit has launched BounceClub for developers and users, where users can participate in various DeFi activities and income-generating activities on the BounceBit mainnet, increasing the richness of BTC asset earnings.

Source:https://x.com/bounce_bit/status/1771481179683692656?s=46&t=ODDW1eIwucwwKwUR-9MGBg

In terms of sources of income, by participating in BounceBit's staking and on-chain financial interactions, users can get yield on their assets:

- CeFi yield from native assets under centralized exchange sub-accounts.

- DeFi yield from interactions on the BounceBit chain.

- Staking rewards from using BBTC+BB for staking, as well as restaking profits from LST generated after staking.

In summary, BounceBit, while ensuring asset security through multi-party custodianship, offers multiple ways to generate yield.

HTX Ventures Investment in BounceBit

HTX Ventures, being a principal investor in Bouncebit, is confident that Bouncebit is able to address a significant and genuine market demand by leveraging its centralized custody model built upon a standard sidechain.

BounceBit's primary objective is to tackle issues such as interest on BTC assets, underutilization of idle BTC, lack of innovation, and high gas fees. Essentially, it aims to provide diverse revenue streams, mitigating Bitcoin's challenge of lacking smart contracts. Current solutions for enhancing the BTC ecosystem include Layers-2s and sidechains.

Layer-2 solutions execute Bitcoin transactions off-chain to enhance transaction speed. Examples of Layer-2s include state tunnels and rollups. State channels, like the Lightning Network, have limited scalability and mainly focus on expediting peer-to-peer transactions, making it challenging to deploy Ethereum-level smart contracts. Rollups lack sufficient trust guarantees as Bitcoin Layer-2 solutions cannot be verified by the mainnet upon returning the ledger due to issues with underlying code and signature verification. The most promising approach currently involves upgrading Bitcoin's BIP layer and updating miners' underlying codes based on new Taproot protocols to support OP/ZKP verification and Bitcoin miner calculation. However, there may still be a long way to go before rollups' implementation.

Sidechains function as independent chains, allowing users to map Bitcoin from mainnets for application. While sidechains offer better processing speeds, they lack trust verification from the Bitcoin mainnet, thus raising concerns about trust and consensus. Additionally, project misconduct is more likely to occur, jeopardizing the security of mapped assets. This TVL dilemma is common among most sidechains.

BounceBit posits that the infrastructure related to Bitcoin is primarily asset-driven, emphasizing how BTC can be utilized in new environments or chains. Unlike focusing on building layer 2 solutions directly atop the Bitcoin chain, BounceBit stands as an isolated PoS layer one. Here, nodes stake both BTC and BounceBit tokens to ensure the security of the chain. The connection between BounceBit and BTC is established at the asset level rather than the protocol level.

BounceBit seeks to address the consensus and trust issues of sidechains through centralized custody on top of a regular sidechain. Given current circumstances, this combination of centralization and decentralization may offer a compromise to solve both technical and trust issues. BounceBit's design mechanism and development team have created a competitive edge and opened up opportunities within the sector.

Outlook

With the approval of BTC spot ETFs, institutions and individuals worldwide are increasing their holdings of BTC, spurring a surge in the BTC prices. BTC now ranks among the top 10 assets globally by market capitalization. Additionally, BTC inscriptions and scaling are two niche segments gaining widespread traction in this market cycle. The progress in these areas has sparked excitement in the market, drawing more attention to the BTC ecosystem. Developers and market participants are exploring additional BTC-based use cases and income opportunities.

BounceBit, as a product combining CeFi and DeFi, possesses a certain degree of innovation in its product model. By integrating centralized and decentralized mechanisms, it introduces a tri-party custodianship mechanism into the trust solution, creating new EVM chain assets to invigorate the financial attributes of native assets, potentially becoming a new solution for the Bitcoin ecosystem. Moreover, the project team has demonstrated excellent capabilities in product operation and traffic generation.

HTX Ventures expects more technical breakthroughs in the BTC ecosystem, accompanied by the emergence of more ecosystem projects. This trend will fuel excitement and anticipation. Currently, BounceBit's combination of CeFi and DeFi has promising potential for TVL growth and is poised to diversify revenue streams from BTC ecosystem assets.

*Special thanks to BounceBit for their support in writing this article.

About HTX Ventures

HTX Ventures, the global investment division of HTX, integrates investment, incubation, and research to identify the best and brightest teams worldwide.

With a decade-long history as an industry pioneer, HTX Ventures excels at identifying cutting-edge technologies and emerging business models within the sector. To foster growth within the blockchain ecosystem, we provide comprehensive support to projects, including financing, resources, and strategic advice.

HTX Ventures presently backs over 200 projects spanning multiple blockchain sectors, with select high-quality initiatives already trading on the HTX exchange. Furthermore, as one of the most vigorous Fund of Funds (FOF) investors, HTX Ventures collaboratively forges the blockchain ecosystem alongside premier global blockchain funds, including IVC, Shima, and Animoca.

Contact Details

Michael Wang

Company Website

https://www.htx.com/en-us/ventures

View source version on newsdirect.com: https://newsdirect.com/news/htx-ventures-why-bouncebits-innovative-solutions-might-be-key-to-unlock-the-bitcoin-btc-ecosystem-271151466

HTX Ventures

COMTEX_449958748/2655/2024-03-28T05:01:02

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Current Hue journalist was involved in the writing and production of this article.